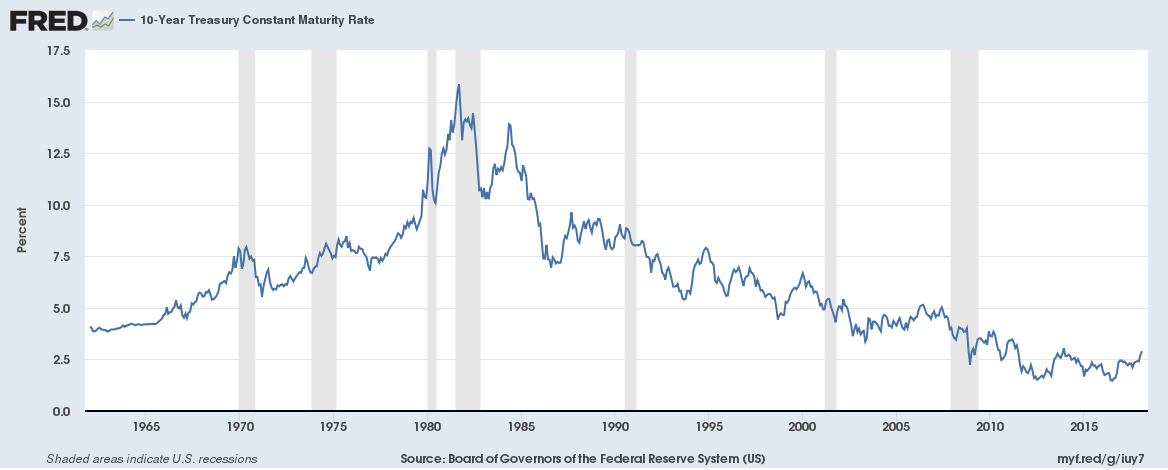

Two generations of investors have imprinted in their brains that interest rates are benign – they rise only occasionally and for painful, but brief, interludes. Declining and low interest rates provide supercharged boosts to the value of all long term financial assets – bonds of course, stocks, real estate, et al. This is the “reality” commonly accepted as normal.

Before the extraordinary peak in 1981, global interest rates had risen for two generations. Subsequently, long term US Treasury rates declined from 15% to recent lows of 2.5%. By most (all?) historical parameters, interest rates have fallen as far as they can. To mitigate the effects of the 2008 implosion of the mortgage markets, rates administered directly by Central Banks have been close to 0%. At the recent trough in global rates, $14 Trillion of issued debt was trading to provide investors negative interest rates. This Central Bank commitment to “whatever it takes” reinforced the notion that interest rates will always be benign.

This 37 year history and the existing perception of “normal” contains within it the potential for dire consequences. Only the aged reprobate class or students of financial history can conceive of the possibility that interest rates could double or more from current levels merely to return to long term norms. Should this happen, both borrowers and investors will suffer.

Borrowers have found it very easy to borrow and carry very large amounts of debt. Consumers and governments are particularly exposed since the term to maturity of the money they owe tends to be very short, meaning that debt service costs will rise very quickly. Perversely, even many conservative savers, desperate for required returns on investments, have sought opportunities in ever more risky places. Unfortunately for the unwary who make investment decisions based on historic returns, a plethora of “fixed” income products have been marketed on the basis of assumed stability of bonds and good historic returns. Many of these products involve borrowing money to leverage the very low returns available in the marketplace. Should interest rates rise, investors will experience the double whammy of declining asset prices and higher borrowing costs.

Central Bankers have begun to raise administered rates. As of early April, rates on US Treasuries have risen by about 35 basis points along the maturity spectrum. Benign is probably over for a generation.